Forest management with carbon scenarios in the central region of Mexico

iForest - Biogeosciences and Forestry, Volume 14, Issue 5, Pages 413-420 (2021)

doi: https://doi.org/10.3832/ifor3630-014

Published: Sep 15, 2021 - Copyright © 2021 SISEF

Research Articles

Abstract

The search for mechanisms to mitigate global warming has generated a series of proposals to reduce deforestation and promote conservation of forests as carbon stocks through financial or in-kind support. However, the economic implications of including carbon sequestration in forest for timber production have not been dealt with in depth, and the conditions in which combined production might be a profitable option to forest owners, particularly in Mexico, are unknown. The aim of this study was to quantify carbon sequestration in a central region of Mexico and evaluate the profitability of selling carbon credits as well as timber products. Data and information used comes from three inventories (2013, 2014 and 2016) taken in 160 permanent sampling plots of 400 m2 each; forest management costs per hectare were obtained through interviews to the landowners, and the profitability was assessed using the economic indicators Net Present Value (NPV), Internal Return Rate (IRR), Benefit-Cost Ratio (BCR), and Land Expected Value (LEV). The results indicate that, in areas of low productivity, carbon sequestration is profitable only at a low discount rate (3.5%) and a high price of the ton CO2e (USD 100 ha-1 year-1). However, under combined production, the optimal rotation periods are longer, depending on the discount rate and price of sequestered carbon. Therefore, timber production will continue to be the main economic activity, until the rules of operation of the different mechanisms created for carbon sequestration become more flexible and the carbon markets offer more attractive incentives.

Keywords

Climate Change, Carbon Sequestration, Productivity, Financial Profitability, Optimal Rotation

Introduction

Climate change (CC) is a statistical variation in the mean state of the climate over a prolonged period. It is produced by natural processes or by persistent anthropogenic changes ([20]). Today, it is undoubtedly one of the issues attracting the most interest and will continue over the upcoming decades. According to Joos & Spahni ([21]), the concentration of carbon dioxide (CO2) in the atmosphere at the beginning of the industrial age (1970) was approximately 277 parts per million (ppm), a value that has increased to 407.38 ± 0.1 ppm in 2018 ([13]). This has intensified the search and development of mechanisms to balance the concentrations of CO2 and other greenhouse effect gases (GEG) and compounds in the atmosphere to detain or reduce global warming.

One of these mechanisms is the Kyoto Protocol, in which developed countries committed to reducing their emissions of GEG by at least 5.2 %, relative to 1990 levels, for the period 2008-2012. In addition, in 2015, 195 countries signed the Paris Agreement, whose objective is to detain the temperature increase in this century to less than 2 °C ([49]). In such agreement, it is recognized that forests play a central role in achieving this goal, since they store large amounts of carbon in both vegetation and soils, and have an important role in the exchange of carbon dioxide between the biosphere and the atmosphere ([3]); therefore, their conservation and restoration are unpostponable. As a result, international policy instruments and programs have emerged such as REDD+ projects, that are based on the provision of financial incentives to conserve forests, improve forest carbon stocks and sustainable forest management ([35]), or the Clean Development Mechanism (CDM), which is an instrument designed to reduce greenhouse gas emissions through the purchase of Certified Emission Reduction Units (CERs) from afforestation or reforestation projects in developing countries ([51]). Under the CDM, several Latin American countries have participated in afforestation and reforestation projects, such as Bolivia, Peru, Paraguay, Uruguay, Brazil, Argentina, Chile. While in REDD+, in 2011, Peru and Brazil had more than 40 pilot projects, being among the countries with the largest number of projects worldwide; Nicaragua, El Salvador, Belize, Panama, Costa Rica have also taken part in this initiative ([26]). Likewise, some countries have made various commitments to contribute to the mitigation of climate change, for example, Colombia and Brazil which committed to restoring 1 and 12 million forest hectares, respectively ([44]), through the Bonn Challenge, which aims to restore 150 million global hectares of degraded lands by 2020.

In 2009, the government of Mexico, through its Special Climate Change Program (Programa Especial de Cambio Climático - PECC), committed to reducing its GEG emissions by 50% to 2050, relative to the quantity emitted in 2000 ([37]). In addition, in the Paris Agreement, the government committed to reducing GEG by 22% and short-lived climate pollutants (SLCPs) by 51% for the year 2030, relative to the base scenario.

Despite the environmental and social benefits obtained under this approach, in Latin America there are few studies related to CC, timber production and carbon sequestration; most of them have been directed only to the quantification of biomass and carbon stocks in natural forests ([38]), forest plantations ([27]) or in determining the climate change mitigation potential of forest ecosystems ([17]). It is therefore necessary to carry out studies to address the production of more than one good or service, such as the production of timber plus the benefits of carbon sequestration, the production of water and biodiversity conservation. Specifically, the inclusion of carbon sequestration benefits to forest harvesting has various implications such as an extended rotation period ([12], [46]). To this respect, Nepal et al. ([32]) found that for Mississippi forest landowners to be willing to extend the rotation period by 5 and 10 years, the prices for captured carbon must be USD 50 and USD 110 per Mg CO2e, respectively. On the other hand, Köthke & Dieter ([24]) mention that including the benefits of carbon sequestration in forest management could be an opportunity to achieve profitability in forest sites that until now were not profitable. Therefore, the economic analysis of alternative scenarios of the joint production of timber plus carbon sequestration through financial indicators represents an adequate alternative to analyze the profitability of forestry and to determine the conditions under such production would be profitable.

The objective of this study was to quantify the carbon sequestration in managed forests in the central region of Mexico, and to evaluate the financial profitability of timber production combined with carbon credits in different alternative scenarios.

Materials and methods

Study area

The study was conducted in the Intensive Carbon Monitoring Site Atopixco, which is located in a forested region of Zacualtipán, Hidalgo state, in the Sierra Madre Oriental (Mexico). It covers portions of ejidos Atopixco, La Mojonera, El Reparo, Tzincuatlán, Zahuastipán and Santo Domingo, and small private land with an area of 900 ha (3 × 3 km - [33]). The site is part of the “Red Méx-SMIC, Intensive Carbon Monitoring Sites network”, established in 2012 in forest landscapes of Mexico, with the aim of obtaining information for the calibration-validation of models of forest carbon dynamics ([4]). The main vegetation types at the regional level are pine-oak forests, oak forests and tropical montane cloud forest.

Forest management in these forests began in the early 1980’s using the Method of Silvicultural Development (MSD), which is a planning scheme based on rotation age ([31]). The regeneration method is a seed tree method prescribing 3 to 4 thinnings evenly spaced during a rotation of 40 to 80 years. The goal is to regenerate forest stands whose age composition and density achieve the maximum average production ([48]). In the last four decades, forest management has been oriented toward developing even-aged forests dominated by Pinus patula, a fast growing species that is endemic to Mexico. The topography of the site is hilly with a mean altitude of 2100 m a.s.l. The predominant soil is Feozem, with good drainage. Climate is humid temperate [C(m)] and subhumid temperate [C(w2)], mean annual temperature is 13.5 °C, and mean annual precipitation is 2050 mm.

Field data

The dataset was obtained from three measurements (2013, 2014 and 2016) of 40 clusters, each consisting of four 400 m2 sampling plots distributed in an inverted “Y” within one hectare. The registered variables were total height (H, m), diameter at breast height (DBH, cm), dominant height (HD, m), number of live trees (NL) and stand age (years) obtained in the field and from the forest management plan.

Financial characterization and discount rate

Average costs per hectare of timber production were obtained through interviews with the agents of forest activity (ejido president, forest administrator, and forest workers), for the stages of stand establishment, maintenance, and harvest, which are the main activities of the forest management process. Fixed costs were obtained from establishment and maintenance, while variable costs were defined in function of timber production.

Discounting future cash flows is an economic practice of long tradition in forest economics, due to the long period of time between stand regeneration ([43]) and final harvest. According to Bettinger et al. ([5]), the discount rate can be nominal or real; the first includes inflation, while the second does not and may or may not incorporate a risk factor. Klemperer ([23]) remarks that there is no risk factor universally used, and its selection will depend on the payment period, the amount of risk in incomes and the degree of aversion to risk of the decision-maker. Worldwide, reported discount rates used in forest investments oscillate between 6% in the northern hemisphere and 15% in the southern hemisphere ([10]). For Mexico, of the few studies conducted to date, Masera et al. ([28]) analyzed the forestry options for carbon sequestration by comparing three study cases and using four real discount rates (0, 3, 5 and 10%). Based on that study and given the high variability of the discount rates used, we opted for real rates of 3.5% and 4.5% without considering a risk factor.

Forest growth systems, timber and carbon yield

Information on growth systems and yield per hectare were obtained from the prediction and projection models of Ramírez et al. ([36]). Aboveground biomass per hectare was estimated from the timber volume of Pinus patula and broadleaf species with factors of direct proportionality of 0.433 and 0.817, respectively ([36], [33]). Aboveground carbon ratio for Pinus patula and broadleaf species were 0.507 and 0.494, respectively ([15]). Carbon estimations in MgC ha-1 were multiplied by 3.667 (ratio between molecular weights of CO2 and carbon, 44/12) because the carbon markets operate in metric tons of carbon equivalent (MgCO2e). In addition, we did not consider the penalty for the re-emission of CO2 into the atmosphere at the time of harvest, since the proportions of the final products are not known of short or long life that the harvested timber will become.

Diameter distribution modeled with the Weibull function

The stand variables proposed were dominant height (HD, m), site index (SI, m), basal area (BA, m2 ha-1), number of trees ha-1 (NT) and quadratic mean diameter (Dq, cm). The height (H, m) by diameter class (D), growth in quadratic mean diameter and total volume (V) were obtained with eqn. 1, eqn. 2 and eqn. 3, respectively:

The parameters that are part of the Weibull function were recovered using the moment method ([42]), while percentiles were estimated with Ordinary Least Squares (OLS - eqn. 4, eqn. 5, eqn. 6):

The parameter location a was estimated as follows (eqn. 7):

while parameter c was calculated as (eqn. 8):

and parameter b was estimated with the expression of the second moment of the Weibull distribution (eqn. 9):

where Γ(.) is the Gamma function, Γ1 = Γ[1+(1/c)] and Γ2 = Γ[1+(2/c)].

Distribution and prices by type of timber product and Mg CO2e

Products were allocated with the equation of Fang et al. ([14]) reported in the Forest Biometric System corresponding to the Unit of Forest Management 1302 Zacualtipán-Molango ([50]). The products considered were: cellulosic (10 ≥ d < 20 cm); secondary (20 ≥ d < 25 cm); and primary products (d ≥ 25 cm). The nominal price by type of product was obtained through interviews in the study region: cellulosic (USD 15 m-3), secondary (USD 40 m-3) and primary (USD 80 m-3). Since the prices per carbon credit (MgCO2e ha-1 year-1) were below USD 75, there were no profitable scenarios. The exchange rate was $20.00 MXN to one dollar.

Updating production costs

To deflate the different values, 2013 was used as the base year because it had the following characteristics: it is a recent year, abundant information is available, reasonable historic economic behavior was registered, normal market conditions, uniformity in price variations, and no catastrophic events occurred (natural disasters, political elections, special events, etc. - [19]).

Present production values (PV) were estimated by type of product discounted at interest rate i with eqn. 10. Wood prices were deflated with eqn. 11, while costs (fixed and variable) of timber production were deflated with eqn. 12 and updated with eqn. 13:

where PV is the discounted production value (USD), Prj is the real price by product type (USD m-3), Qj is the product amount (m3 of timber), Pc is the nominal price of timber (USD m-3), INPP is the National Index of Prices to the Producer with base year 2013, Cck is the nominal cost (USD), Crk is the real cost (fixed or variable, USD), Ctk is the total discounted cost (USD), i is the real discount rate (3.5% and 4.5%), t is the number of years, beginning with the present, in which production is registered, j are the primary, secondary or cellulosic products, k are the stages of forestry process (establishment, maintenance, and timber harvest).

Reineke density index

The Reineke’s stand density index (SDI - eqn. 14) and the equation that represents the number of trees with 1 cm diameter per hectare (eqn. 15) were fit with OLS using 26 sites equivalent to 20% of all the sites of the dataset (130 sites - [41]):

where NT is the number of trees ha-1, Dq is the quadratic mean diameter ha-1, αi are the parameters to be estimated.

Components of the evaluated scenarios

The different scenarios included the following variables and conditions: (i) productivity, site index (SI) of 18 and 30 m; (ii) silvicultural treatments, two thinnings and one regeneration cutting at the end of the rotation period (40 years), and one regeneration cutting at the end of the rotation period; (iii) final product: wood, carbon and a combined production (wood plus carbon); (iv) discount rate: 3.5% and 4.5%, and finally, the price of MgCo2e ha-1, which was USD 75 and USD 100. The combination of these gave rise to different scenarios. The percentage of trees to remove in each thinning was obtained through a density management diagram. The density management diagram is one of the most efficient methods of silvicultural planning and management in even-aged forests ([30]). This enables maximizing individual growth and total biomass production ([41]). Although the MSD considers 3 to 4 thinnings during the rotation period, we limited to two thinnings at 10 and 20 years, and a regeneration cutting at the end of the rotation (40 years). Pinus patula reaches its maximum volume growth between 24 and 27 years ([36]), and another thinning at 30 years of age would not have little effect on the species growth. The scenarios were evaluated based on the final product, timber and captured carbon (Tab. 1).

Tab. 1 - Scenarios evaluated for the condition of pine forest and timber as end product under the silvicultural treatment of two thinnings and one regeneration cutting. (SI): site index.

| Scenario | SI | Discount rate (%) |

Price Mg Co2e (USD) |

Product |

|---|---|---|---|---|

| 1 | 18 | 3.5 | 100 | Timber |

| 2 | 18 | 4.5 | 75 | |

| 3 | 30 | 3.5 | 100 | |

| 4 | 30 | 4.5 | 75 | |

| 5 | 18 | 3.5 | 100 | Carbon sequestration |

| 6 | 18 | 4.5 | 75 | |

| 7 | 30 | 3.5 | 100 | |

| 8 | 30 | 4.5 | 75 |

Financial indicators

The financial indicators used were Net Present Value (NPV), Internal Return Rate (IRR), Benefit-Cost Ratio (BCR) and Land Expected Value (LEV). Eqns. 16 to 19 show the respective algebraic expressions ([9], [39]):

where Bt, Ct are the benefits and costs in the time period t (USD ha-1); t is the time in years; i is the real discount rate (3.5% and 4.5%); i* is the rate that makes the cash flow equal zero; LEV is the land expected value; PVc, PVf are the net present value of the benefits for carbon sequestration and sale of wood; Ad, Ma, Re, Gr, Mr are, respectively, the regeneration administrative costs (USD ha-1), road maintenance costs of regeneration (USD ha-1), regeneration land rent (USD ha-1), costs of regeneration protection, and costs of stand maintenance (USD ha-1), regeneration (USD ha-1); S are the government support granted to the ejidos (USD ha-1); δ is the parameter that expresses the discount factor for annuity; T is the rotation age (40 years).

Determination of the optimal rotation age for combined production

To determine the optimal rotation age for combined production, the equi-marginality criteria were used, that is, when the marginal benefit (MB) and the marginal cost (MC) associated with the decision to harvest are equal. Its mathematical expressions are presented in eqn. 20 and eqn. 21 ([46]):

where i = [cellulosic (ce), secondary (se), and primary products (pr)]; pi is the price of the i-th product; V′i(T) is the marginal increase in volume of the i-th product; Vi(T) is the volume of the i-th product at the end of the planning horizon; V′(T) is the increase in total volume; d is the real discount rate (3.5% and 4.5 %); pc is the price of carbon; α is a constant that expresses the proportion of CO2e per m3 of wood.

Results and discussion

Financial characterization

The costs and percentages during stand establishment (year 1) are shown in Tab. 2. Firebreaks, which are opened on the perimeter of the regeneration area with a minimum width of 3 m, was the costliest (USD 79.16), followed by purchase of seedlings (USD 63.32) and forest tools (USD 48.34 - machetes, axes, hoes, rakes and shovels). The total average cost for the stand establishment was USD 352.54 ha-1, which was equivalent to 45.49% of the total costs (i.e., stages of establishment and maintenance).

Tab. 2 - Activities and real average cost (USD ha-1) for the stand establishment during the first year.

| Establishment | Total (USD ha-1) |

Percentage |

|---|---|---|

| Fencing material | 29.92 | 3.86 |

| Labor for fencing | 27.49 | 3.61 |

| Cost of seedlings | 63.32 | 8.17 |

| Transportation costs of seedlings | 5.28 | 0.68 |

| Labor for seedling establishment | 54.19 | 6.99 |

| Opening roads | 44.33 | 5.72 |

| Opening fire-breaks | 79.16 | 10.21 |

| Tools | 48.34 | 6.24 |

| Total | 352.54 | 45.49 |

Maintenance involved six activities (Tab. 3) and accounts for 54.51% of the total fixed costs (not considering harvesting costs). Costs of land rent and protection against pests and fires are covered throughout the rotation period (40 years) and add up to USD 101.98 ha-1 year-1. Cleaning of the planted land (chapeo), pruning and liberation cutting are carried out during the first 8 years of the stand with an annual cost of USD 120.49 ha-1. Maintenance of firebreaks and roads has a cost of USD 133.40 ha-1 in the second year and USD 66.60 ha-1 year-1 from the third and successive years. The total cost, considering the establishment and maintenance stages for the planning horizon was USD 775.03 ha-1.

Tab. 3 - Activities and real average cost (USD ha-1) for the maintenance stage.

| Maintenance | Total (USD ha-1) |

Periodicity | Percentage |

|---|---|---|---|

| Land rent | 65.65 | Yearly | 8.47 |

| Protection against pests | 28.24 | Yearly | 3.64 |

| Protection against fires | 8.09 | Yearly | 1.04 |

| Clearing | 69.43 | Until year 8 | 8.95 |

| Pruning and liberation cutting | 51.05 | Until year 8 | 6.58 |

| Maintenance of fire-breaks | 87.35 | Only during the 2nd year | 11.27 |

| Maintenance of roads | 46.05 | Only during the 2nd year | 5.94 |

| Maintenance of fire-breaks | 43.57 | As of the 3rd year | 5.62 |

| Maintenance of roads | 23.03 | As of the 3rd year | 2.97 |

| Total | 422.48 | - | 54.51 |

Harvest activities had a total cost of USD 12.23 m-3 extracted and includes the cost of forest technical services (USD 1.50 m-3); on site processing (felling, sectioning and moving logs to the drag track) costs USD 8.07 m-3, while for final cutting and thinning (regardless of the type of product) and costs of administration was USD 2.68 m-3.

During the rotation period, the ejido receive diverse subsidies from the federal government through the National Forestry Commission (CONAFOR) to achieve different activities including a payment for environmental services destined to conservation of forested areas that have been excluded from timber production (Tab. 4).

Tab. 4 - Average Mexican government subsidy, in real terms (USD ha-1), in support of forestry activity in the region.

| Subsidy | Total (USD ha-1) |

Periodicity |

|---|---|---|

| Fencing | 49.68 | First year |

| Planting | 73.26 | First year |

| Road maintenance | 34.72 | Every year |

| Cleaning of the planted land (chapeo) and pruning | 44.24 | Until 8 years |

| Payment for environmental services | 78.24 | Every year |

| Total | 280.17 | - |

In the harvesting stage, an aspect that called our attention was the high cost of administration. Every cubic meter of extracted timber had a cost of USD 2.68 (21.97% of the total cost of this stage), added to the costs of in site processing of USD 0.07 (65.99 %) and USD 1.50 (12.04 %) for forest technical services, making a total of USD 12.23 m-3. The costs of administration during timber harvest are considered high. On average, this harvest activity is carried out by four people, who work approximately four months, but with adequate organization, it could be done by two people. However, trying to reduce these costs is complicated because the ejidos highly value the social features (i.e., job generation).

The Reineke’s stand density index and thinning regime

Fitting of the Reineke’s stand density index model had an R2-adj of 0.96, as well as statistical significance in its parameters. The following is the final model (eqn. 22):

where NT is the number of trees ha-1, Dq is the quadratic mean diameter (cm).

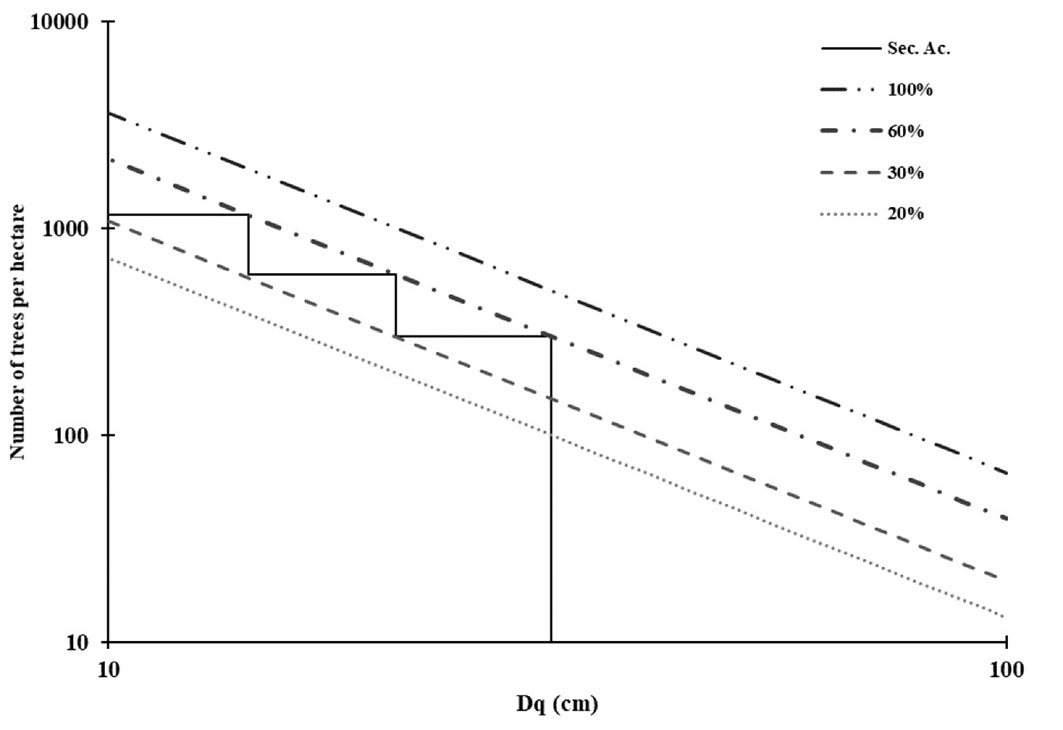

The density management diagram generated for an initial 1200 trees suggests two intensive thinnings before harvest (40 years - Fig. 1). This result coincides with Santiago et al. ([41]), who indicated that in Pinus patula stands in a geographic area near our study site, thinning intensity should be 50% at each intervention.

Fig. 1 - Thinning prescription for Pinus patula stands in Zacualtipán, Hidalgo. (Sec. Ac.): thinning intensity; (100% and 60%): upper and lower limit of the area of self-thinning; (30%): upper limit of the area of constant growth; (20%): lower limit of growth free of mortality.

Thinnings occur at a Dq of 14.34 and 20.90 cm, while the final cutting is at 31.5 cm at the age of 10, 20 and 40 years, respectively. The thinning intensity suggested is 48% and 50% for the first and second thinnings. This does not consider natural mortality since in natural stands with densities below 1000 threes ha-1, the mortality rate is low (0.81% - [36]). Therefore, decreasing the number of individuals was the consequence of only silvicultural interventions.

Scenarios for pine forest

Tab. 5presents the financial indicators obtained for the scenarios generated for timber as the final product. For all the scenarios in which two thinnings and one regeneration cutting are applied (scenarios 1, 2, 3, and 4), the results indicate that timber production is profitable, with PNV of 735.79 to USD 1838.31 ha-1, IRR of 6.09 to 6.51% with BCR of more than one, and positive LEV values. Undoubtedly, the scenarios with SI 30 have better results than those with SI 18 and are even better when low interest rates are considered, as was shown with an interest rate of 3.5%. Application of thinnings is of great importance in forest management because it permits redistribution of growth and manipulation of tree spacing, favoring growth of the target individuals and species ([29]).

Tab. 5 - Financial indicators obtained for the scenarios of SI 18 and SI 30, with timber as the end product.

| Scenario | SI | Discount rate (%) |

NPV (USD) |

IRR (%) |

BCR | TT (yrs) |

LEV (USD) |

|---|---|---|---|---|---|---|---|

| 1 | 18 | 3.5 | 1512.54 | 6.09 | 1.25 | 29 | 650.16 |

| 2 | 18 | 4.5 | 735.79 | 6.09 | 1.14 | 29 | -114.47 |

| 3 | 30 | 3.5 | 1838.31 | 6.51 | 1.28 | 27 | 920.74 |

| 4 | 30 | 4.5 | 974.84 | 6.51 | 1.17 | 27 | 51.76 |

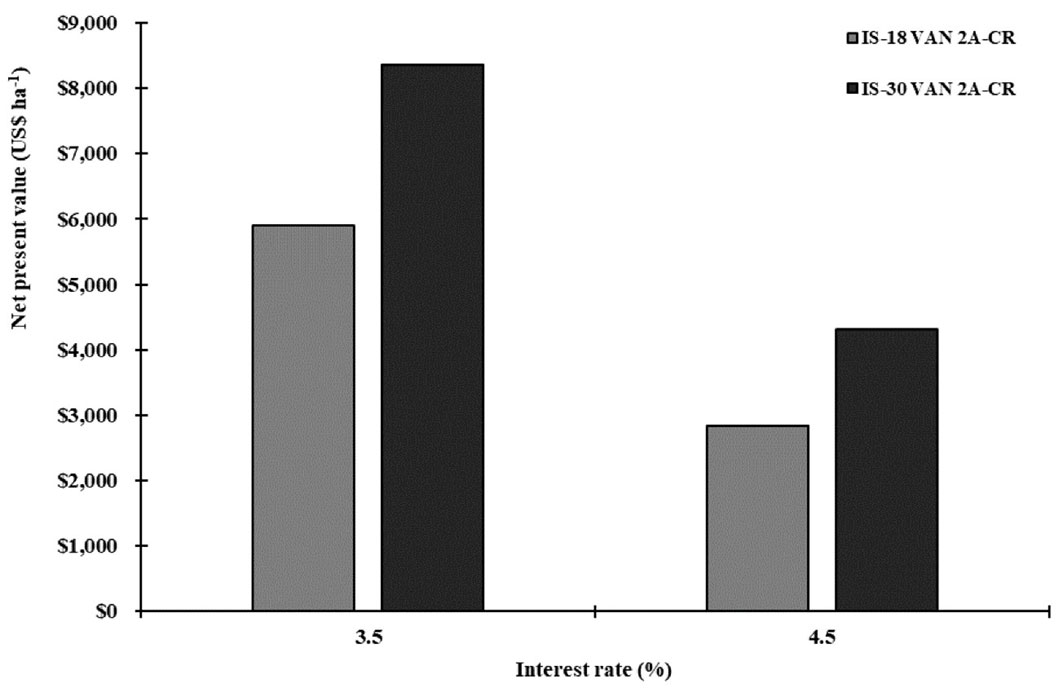

For the scenario of not harvesting at the rotation age and entering to the market of carbon credits to commercialize sequestered CO2e stored in the forest stand, estimated financial indicators are optimistic under certain conditions. Fig. 2 shows the NPV for the different scenarios; the highest value is obtained in SI 30, with two thinnings and one regeneration cutting, a discount rate of 3.5% and a price of USD 100 per MgCO2e ha-1 year-1 (scenario 7), while the lowest value occurred in SI 18 with two thinnings and the regeneration cutting, a discount rate of 4.5% and a price of USD 75 (scenario 6).

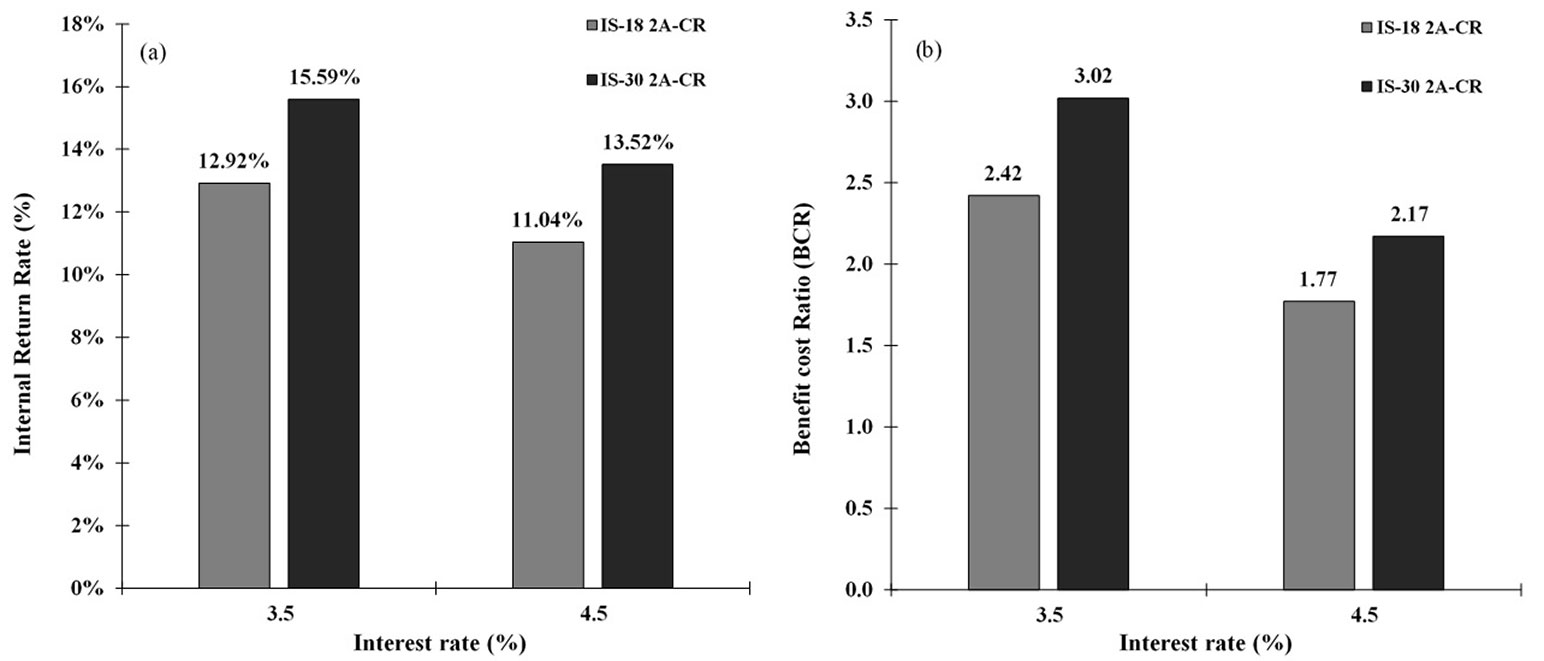

The values obtained for IRR ratify the finding for NPV (Fig. 3a). The proposed scenarios (no. 5, 6, 7, and 8) for SI 18 and SI 30 had values above 10%. Under the defined conditions, the discount rate used can increase to 10% and, even then, the project would still be profitable. On the other hand, Fig. 3b shows the BCR for different scenarios. The highest value was obtained in scenario 7, in which USD 2.02 would be received for every dollar invested, while in scenario 6, there would be a profit of USD 0.77 for each dollar invested.

Fig. 3 - (a) Internal return rate (IRR - %) and (b) benefit cost ratio (BCR) obtained in the scenarios with SI of 18 and 30.

Optimal rotation period for timber production plus carbon sequestration

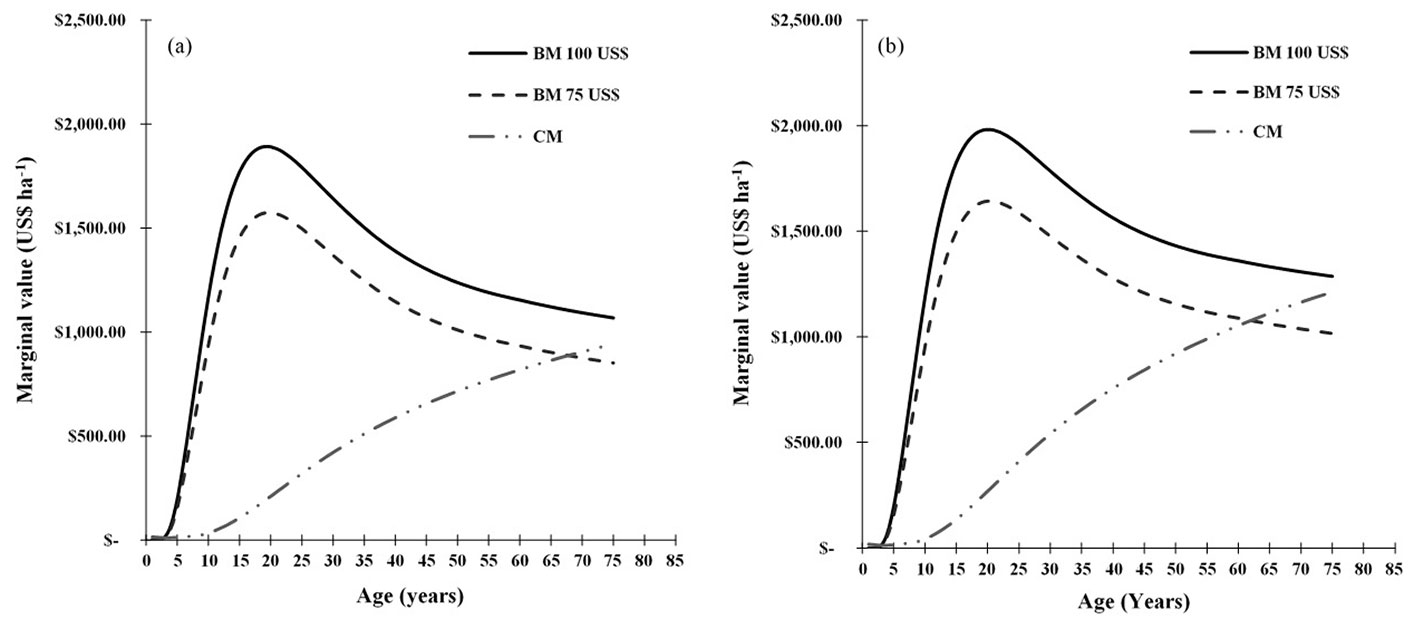

The technical rotation determined for SI 30 was 37 years, but if a combined production is selected, the optimal rotation period (i.e., when BM = CM) lengthens. With a discount rate of 3.5% and a price of USD 100 per MgCO2e ha-1 year-1 captured, the optimal rotation period was more than 75 years. However, using the same discount rate, but at a price of USD 75, the rotation period is 69 years (Fig. 4a). Using a discount rate of 4.5% with a price of USD 100 and USD 75 per MgCO2e ha-1 year-1 captured, the optimal periods are 75 and 63 years, respectively (Fig. 4b). This implies that when the discount rate increases, the optimal rotation period decreases. This behavior was also reported by Abedi et al. ([1]) and Keles ([22]). The extent of the rotation age, including carbon sequestration benefits, has been documented by several authors. Abedi et al. ([1]) evaluated two Populus deltoides plantations in northern Iran and found that, by including carbon sequestration, the rotation ages increased from 10 to 14 years for tree density of 3 by 3 m and from 8 to 11 years for the 3 × 4 m. Similarly, Keles ([22]) determined the optimal cutting ages in plantations of Turkish pine (Pinus brutia Ten.), under different crop spacing and found that without considering the benefits from carbon sequestration, the optimal cutting ages were between 29 and 32 years; however, when these benefits were included, the optimal ages were between 33 and 39 years. Likewise, Gutrich & Howarth ([18]) explored different types of forest in the state of New Hampshire, USA and found that the optimal rotation period without considering carbon sequestration varied from 34 to 44 years, depending on the type of forest, and when considering low marginal benefits from carbon sequestration, the optimal rotation period was 53 to 177 years.

Fig. 4 - Optimum rotation period in a SI of 30 for combined production. Prices for MgCO2e ha-1 year-1 of USD 100 and USD 75 with a discount rate of (a) 3.5% and (b) 4.5%.

Timber production or carbon sequestration

In general, timber production involves a series of high costs attributable to establishment and maintenance over the rotation period (40 years). In productive areas with SI of 24, 30 and 36, this activity is profitable, but in poor sites (SI 18), it is not. Therefore, productive zoning of the forest becomes fundamental since forest exploitation is usually carried out on relatively large areas and the above is not considered.

The Mexican government endeavors to encourage ejidos to conserve their forests through a series of programs ([7]). However, these efforts have not had the expected results, nor have they been able to totally cover the demand. There are several conditions and requirements that hinder the access to some of the support intended for forest activity. For example, incorporating a project under the Clean Development Mechanism (CDM) requires that additionality be demonstrated ([11]), meaning that the reduction of CO2 emissions of a new project are higher than those that would occur without the project. In addition to approaching baseline problems of the project and possible leaks, the compensations occasionally continue to be the same. This has influenced the forest owners’ decisions to not include carbon sequestration as a viable alternative ([16]).

Regarding REDD+, Stern ([45]) mentions that decreasing emissions from degradation and deforestation by 50% in developing countries by 2030 could cost between 15 and 33 billion dollars annually. For this reason, implementing actions in the short term aimed to decrease these emissions would be profitable, especially when it is contrasted with the enormously high environmental and economic costs resulting from inaction.

An alternative to CDM is the voluntary market, where the exchange of emissions certificates is not regulated by specific legal norms and have been, to date, the only source of funding for projects to reduce emissions from deforestation and forest degradation (REDD+ - [40]). In this panorama, forming part of a voluntary market might be the best option. However, the average price per MgCO2e is USD 10 ([25]). According to our results, it is not enough to cover maintenance costs. Therefore, going from timber production to combined production is still uncertain and complicated.

Postponing harvest of a stand is profitable when the forest growth rate is higher than the defined discount rate. If not, it is better not to delay harvest and sell ([2]). However, delaying harvesting, even if it is not profitable, would increase social benefit since all the carbon stored would remain sequestered for a longer time. In Mexico, 60% of the forested area is owned by ejidos and indigenous communities ([47]), and these areas have an important role in reducing poverty, dealing with social exclusion, and jobs generation ([34]). The owners of these forests, who mostly belong to middle and poor economic classes, are highly dependent on the products they harvest, and ceasing to use the forest would bring consequences in terms of opportunity costs, while people with more resources would be willing to pay for improving their health and development through the supply of fresh air, water, scenery ([8]), and other benefits the forest provides. According to Blomley & Iddi ([6]), forests have a much more important role as sources of cash for poor homes than for relatively rich homes. For this reason, it is difficult to destine forests only to carbon sequestration and storage given the conditions of the ejidos and communities of Mexico.

Conclusions

Destining low-productive areas to carbon sequestration is profitable only if payment for MgCO2e is at least USD100 per ha-1 year-1, and if the discount rate is less than 3.5%. Combining timber production with carbon sequestration would involve extending the rotation period, which are sensitive to the discount rate and to the price of MgCO2e captured. Longer optimal rotation aged implies that the CO2 stored in the forest stands to be intervened would remain for a longer time, and the benefits it would generate would be more of a social than economic nature.

Timber production will remain as the main economic option at least the rules to operate of the different national and international carbon mechanisms become more flexible, and the carbon markets offer better economic incentives.

The characterization of the costs incurred in each stage of forest management allowed detecting areas of opportunity for the forestry enterprises studied, which can help them becoming more efficient, effective and competitive.

References

Gscholar

Gscholar

Online | Gscholar

Gscholar

CrossRef | Gscholar

Gscholar

Gscholar

Gscholar

CrossRef | Gscholar

Gscholar

Gscholar

CrossRef | Gscholar

CrossRef | Gscholar

Gscholar

Online | Gscholar

CrossRef | Gscholar

Gscholar

CrossRef | Gscholar

Online | Gscholar

CrossRef | Gscholar

Authors’ Info

Authors’ Affiliation

Manuel de Jesús González-Guillén 0000-0003-1814-4320

Héctor Manuel De Los Santos-Posadas 0000-0003-4076-5043

Gregorio Ángeles-Pérez 0000-0002-9550-2825

Colegio de Postgraduados, km. 36.5 Carr. Mexico-Texcoco, Montecillo, Texcoco, C.P. 56230 (México)

Instituto de Estudios Ambientales-División de Estudios de Postgrado-Ingeniería Forestal, Universidad de la Sierra Juárez, Avenida Universidad s/n, C. P. 68725, Ixtlán de Juárez, Oaxaca (México)

Corresponding author

Paper Info

Citation

Ramírez-Martínez A, González-Guillén MJ, De Los Santos-Posadas HM, Ángeles-Pérez G, Santiago-García W (2021). Forest management with carbon scenarios in the central region of Mexico. iForest 14: 413-420. - doi: 10.3832/ifor3630-014

Academic Editor

Marco Borghetti

Paper history

Received: Aug 19, 2020

Accepted: Jul 13, 2021

First online: Sep 15, 2021

Publication Date: Oct 31, 2021

Publication Time: 2.13 months

Copyright Information

© SISEF - The Italian Society of Silviculture and Forest Ecology 2021

Open Access

This article is distributed under the terms of the Creative Commons Attribution-Non Commercial 4.0 International (https://creativecommons.org/licenses/by-nc/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

Web Metrics

Breakdown by View Type

Article Usage

Total Article Views: 34176

(from publication date up to now)

Breakdown by View Type

HTML Page Views: 28259

Abstract Page Views: 2571

PDF Downloads: 2782

Citation/Reference Downloads: 6

XML Downloads: 558

Web Metrics

Days since publication: 1626

Overall contacts: 34176

Avg. contacts per week: 147.13

Article Citations

Article citations are based on data periodically collected from the Clarivate Web of Science web site

(last update: Mar 2025)

Total number of cites (since 2021): 3

Average cites per year: 0.60

Publication Metrics

by Dimensions ©

Articles citing this article

List of the papers citing this article based on CrossRef Cited-by.

Related Contents

iForest Similar Articles

Research Articles

Heuristic forest planning model for optimizing timber production and carbon sequestration in teak plantations

vol. 10, pp. 430-439 (online: 24 March 2017)

Research Articles

Potential impacts of regional climate change on site productivity of Larix olgensis plantations in northeast China

vol. 8, pp. 642-651 (online: 02 March 2015)

Research Articles

Voluntary carbon credits from improved forest management: policy guidelines and case study

vol. 11, pp. 1-10 (online: 09 January 2018)

Research Articles

Roadside vegetation: estimation and potential for carbon sequestration

vol. 3, pp. 124-129 (online: 27 September 2010)

Research Articles

Modelling the carbon budget of intensive forest monitoring sites in Germany using the simulation model BIOME-BGC

vol. 2, pp. 7-10 (online: 21 January 2009)

Research Articles

Climate-wise models of biomass productivity for hybrid poplar clones in Europe

vol. 16, pp. 188-194 (online: 30 June 2023)

Research Articles

Modeling air pollutant removal, carbon storage, and CO2 sequestration potential of urban forests in Scotlandville, Louisiana, USA

vol. 9, pp. 860-867 (online: 22 September 2016)

Editorials

Change is in the air: future challenges for applied forest research

vol. 2, pp. 56-58 (online: 18 March 2009)

Research Articles

Identifying priority conservation areas for above-ground carbon sequestration in Central Mexico

vol. 10, pp. 923-929 (online: 07 December 2017)

Research Articles

First vs. second rotation of a poplar short rotation coppice: leaf area development, light interception and radiation use efficiency

vol. 8, pp. 565-573 (online: 27 April 2015)

iForest Database Search

Google Scholar Search

Citing Articles

Search By Author

Search By Keywords